BDA Compensation And Travel Planning Release Notes 2024.08.22.1

NOTICE

If your implementation of Compensation makes extensive use of Custom Fields 1/2 and Reporting overrides and you are running into issues with your environment--please contact the BDA Product Team for guidance on optimization and resolution.

BDA Core Technology Compatibility

This version needs at-least Core Technology 2024 08 22 01

OneStream Version Compatibility

This version is confirmed to work with OneStream version 6.3.x to 8.2.x

BDA Compensation and Travel Planning and Extensible dimensions (1)

If you are installing BDA Compensation and Travel Planning on a fresh application, Comp dimensions will get attached to the RootDim and using extensibility in these dimensions will be difficult. Keep in mind that on an existing application if you have a Top member in (UD1-UD8), Comp dimensions will use the dimension that has the "Top" member as the inherited dimension.

- Perform this check before installing the product.

Notes

-

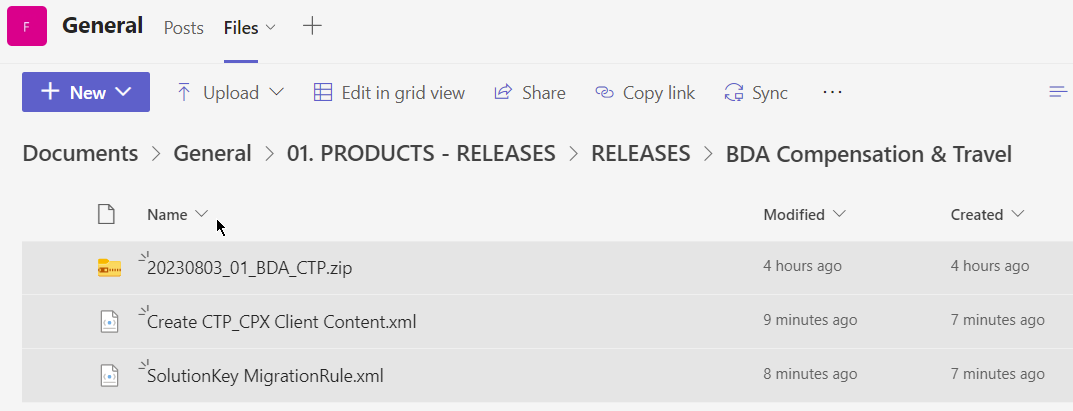

If you are coming from a previous version that does not have "BDA Compensation and Travel Planning Client Content" Maintenance Unit.

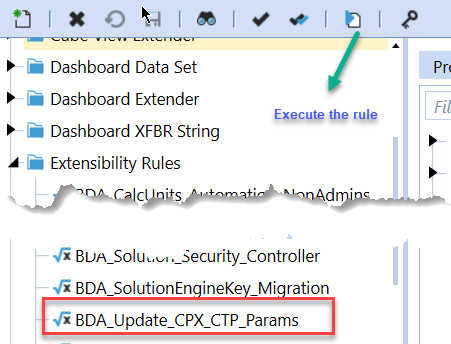

- Please download and upload Create CTP_CPX Client Content.xml to the target.

- Go to Business Rules and execute the rule to create the client content.

-

If you are coming from a version that still uses "BDA_SolutionEngineKey" to add Admin users to Compensation model.

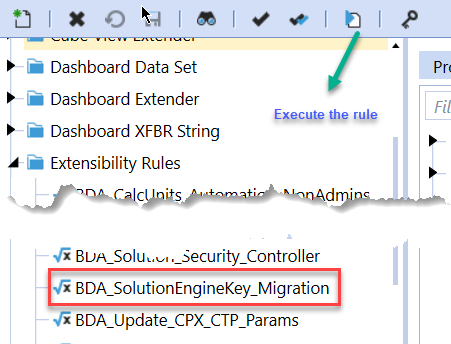

- Please download and upload SolutionKey MigrationRule.xml to the target.

- Go to Business Rules and execute the rule to migrate old solution engine key users to new relational model.

Reserved Keywords

The following keywords cannot be used in BDA solutions (Columns aliases, member names)

- ID

- CalcUnit

- Calc Unit

- UnitName

- Unit Name

Cube View updates needed coming to this release

If you are coming from a version prior to 2023.08.31.01, please go through the corresponding release note for the updates.

Download

New Features

- Currency conversion.

- Created new views for querying employee target overrides:

- vBDA_CTP_CalcUnitMapping : Used to view Calculation Unit overrides.

- vBDA_CTP_CalculationMapping : Used to view Calculation and Formula overrides.

- vBDA_CTP_Custom1Mapping : Used to view Custom Field 1 overrides.

- vBDA_CTP_Custom2Mapping : Used to view Custom Field 2 overrides.

- vBDA_CTP_Custom3Mapping : Used to view Custom Field 3 overrides.

- vBDA_CTP_ReportingMappingOverride : Used to view Reporting Mapping overrides.

- vBDA_CTP_EmployeeTargetMapping : Used to view the final Target member script override and view where the Dimension derived its value.

- The most useful of these views is likely vBDA_CTP_EmployeeTargetMapping for debugging purposes. For screenshots, please see Detailed New Features section.

- Canada tax calculations.

Improved Functionality

Account filter in Employee details report. All currencies in Employee details report.

Issues

Resolved

- [IN#01285] Fixed issue where decoded Employee Data does not include UD5 when pulling from cached table causing display issues in cube view.

Known

Detailed New Features

Currency conversion

Currency conversion can be used in Compensation if the employee in a calc unit is getting paid in a currency other than the calc unit's currency.

From this version onwards, you can configure a column in Loaded, Transfer, Planned employees views called "Planned Currency"

Once added to the respective screen, you can now use this column to set the currency for the employees that are getting paid in a different currency.

If nothing is added to this column, the employee will be calculated as local. (Previous calc behavior). If you've assigned an employee's planned currency as the same as the calc unit's currency, no conversion will take place.

In this example we are going to look at an Employee in a USA Calc unit.

Let's change his planned currency to be Canadian dollars.

After the save, you'll see that "Base" and every other accounts are now converted to US Dollars from the paid CAD.

Comp calculation looked at the FX rates stored in the system. In this case "Working" scenario is using AverageRate.

Then did the math as follows. 200,000/1.342316667 this made that employee's annual salary in USD as 148,996.14. Comp then distributed that salary to every month based on the Days in month and the result of 12416.35 is stored in the tables.

Reference calcs are now updated to show this change, you can use GetDriver("PayCurrency") to get the Employee's Planned currency.

Canada Tax Calculations

Common Canada tax calculations are added as built-ins

| Calculation Name | Description | Formula |

|---|---|---|

| CPP | Canada Pension Plan | (Total annual remuneration (capped at the maximum threshold)-monthly exemption) * Rate |

| CPP2 | Additional Canada Pension Plan | Remuneration between CPP Cap and CCP2 Cap * Rate |

| QPP | Quebec Pension Plan | (Total annual remuneration (capped at the maximum threshold)-monthly exemption) * Rate |

| QPP2 | Additional Quebec Pension Plan | Remuneration between QPP Cap and QPP2 Cap * Rate |

| EI | Canada Employment Insurance | Total annual remuneration (capped at the maximum threshold) * Rate |

| QPIP | Quebec Parental Insurance Plan | Total annual remuneration (capped at the maximum threshold) * Rate |

| CAN Workers Comp | CAN Workers' Compensation | Total annual remuneration (capped at the maximum threshold) * Rate |

| EHT | Employer Health Tax | Earnings * EHT Provincial Rate |

| RRSP | Registered Retirement Savings Plan | Earnings * RRSP Rate |

Each calculation have drivers(assumptions) that can be define/configure base on the current tax definitions

| Driver Name | Description | Calculation |

|---|---|---|

| CPP Rate | Canada Pension Plan Annual Rate | CPP |

| CPP Cap | Canada Pension Plan Annual Cap | CPP |

| CPP Exemption | Canada Pension Plan Annual Exemption | CPP |

| CPP2 Rate | Additional Canada Pension Plan Annual Rate | CPP2 |

| CPP2 Cap | Additional Canada Pension Plan Annual Cap | CPP2 |

| QPP Rate | Quebec Pension Plan Annual Rate | QPP |

| QPP Cap | Quebec Pension Plan Annual Cap | QPP |

| QPP Exemption | Quebec Pension Plan Annual Exemption | QPP |

| QPP2 Rate | Additional Quebec Pension Plan Annual Rate | QPP2 |

| QPP2 Cap | Additional Quebec Pension Plan Annual Cap | QPP2 |

| EI Rate | Employment Insurance Annual Rate | EI |

| EI Cap | Employment Insurance Annual Cap | EI |

| Quebec EI Rate | Quebec Employment Insurance Annual Rate | EI |

| QPIP Rate | Quebec Parental Insurance Plan Annual Rate | QPIP |

| QPIP Cap | Quebec Parental Insurance Plan Annual Cap | QPIP |

| CAN Workers Comp Rate (per province) | CAN Workers' Compensation Annual Rate | CAN Workers Comp |

| CAN Workers Comp Cap (per province) | CAN Workers' Compensation Plan Annual Cap | CAN Workers Comp |

| EHT Rate (per province) | EHT Annual Rate | EHT |

| RRSP Rate | RRSP Annual Rate | RRSP |

Both CAN WorKers Comp and EHT are at province level, as rate and cap can be varied across provinces, the client will need to define/configure each province

Assumptions example (with latest 2024 official tax rates):

| Description | 2024 | 2025 |

|---|---|---|

| CPP Cap | 68500.0000 | 68500.0000 |

| CPP Exemption | 3500.0000 | 3500.0000 |

| CPP Rate | 0.0595 | 0.0595 |

| CPP2 Cap | 73200.0000 | 73200.0000 |

| CPP2 Rate | 0.0400 | 0.0400 |

| EI Cap | 63200.0000 | 65700.0000 |

| EI Rate | 0.0232 | 0.0230 |

| QPIP Cap | 94000.0000 | 94000.0000 |

| QPIP Rate | 0.0069 | 0.0069 |

| QPP Cap | 68500.0000 | 68500.0000 |

| QPP Exemption | 3500.0000 | 3500.0000 |

| QPP Rate | 0.0640 | 0.0640 |

| QPP2 Cap | 73200.0000 | 73200.0000 |

| QPP2 Rate | 0.0400 | 0.0400 |

| Quebec EI Rate | 0.0185 | 0.0183 |

Setup Requirement

In order for the build-in tax calculations to determine the correct province, the "region" field need be config to use "CTP_Drivers_Province - CAN", for example, use "Config_Region" as the parameter to return the list of the provinces.

vBDA_CTP_EmployeeTargetMapping

vBDA_CTP_EmployeeTargetMapping is able to be queried directly via SQL Tools. Within this view, you will find a list of all currently active employees and calculations applied to those employees. Each dimension in this view represents the target dimension this asset and calculation is going to be pushed to for reporting. The combination of all these dimensions represents the target Member Script where the data will go to.

Additionally, if you scroll to the right more, you are able to see exactly where these dimension values are derived from in the override hierarchy for easier debugging. Note that if a dimension is labeled as "Not Specified", this means that this dimension is never specified at any point of the override process or at the Base Script level.

Detailed Improved Functionality

Account filter in Employee details report

From this release onwards, employee details report supports filtering of accounts.

You can select multiple accounts to filter the results.

Currencies in Employee details report

Currencies in employee details report now supports all the currencies that are present in the system.

Pay Currency will show the results of employees in their paid currency.

Entity Currency will show the current stored results of the employees.

For example, the below report shows all the employees in USD (irrespective of the entity/employee planned currency)

The below report shows all the employees in CAD (irrespective of the entity/employee planned currency)

Upcoming Features

Rollback upto last 5 data load

An option to roll back the loaded data to last 5 data loads

Load comparision report

A report that will show the differences between current load and last 5 data loads

Enable notifications

An option to enable notifications for Administrators for the following.

- Calculation unit addition

- User Management changes

- Data Load

Solution Management

- An option to uninstall Compensation and Travel planning.

- An option to update/revert client configuration parameters.

Installation and Configuration Instructions

Installation

Info

The below steps must be performed for both a fresh install or an upgrade from a previous version.

- Make sure that at least one valid workflow profile is setup and selected ahead of installing the BDA Compensation and Travel Planning.

- If you are coming from a previous version that does not have "BDA Compensation and Travel Planning Client Content" Maintenance Unit, please talk to Product team about migrating the Config parameters to the "BDA Compensation and Travel Planning Client Content" Maintenance Unit.

- If you are coming from a version that still uses "BDA_SolutionEngineKey" to add Admin users to Compensation model, please talk to Product team about migrating the admin users to the latest relational model.

- Upload Zip File into Application -> Load/Extract -> Load

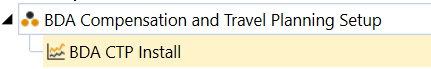

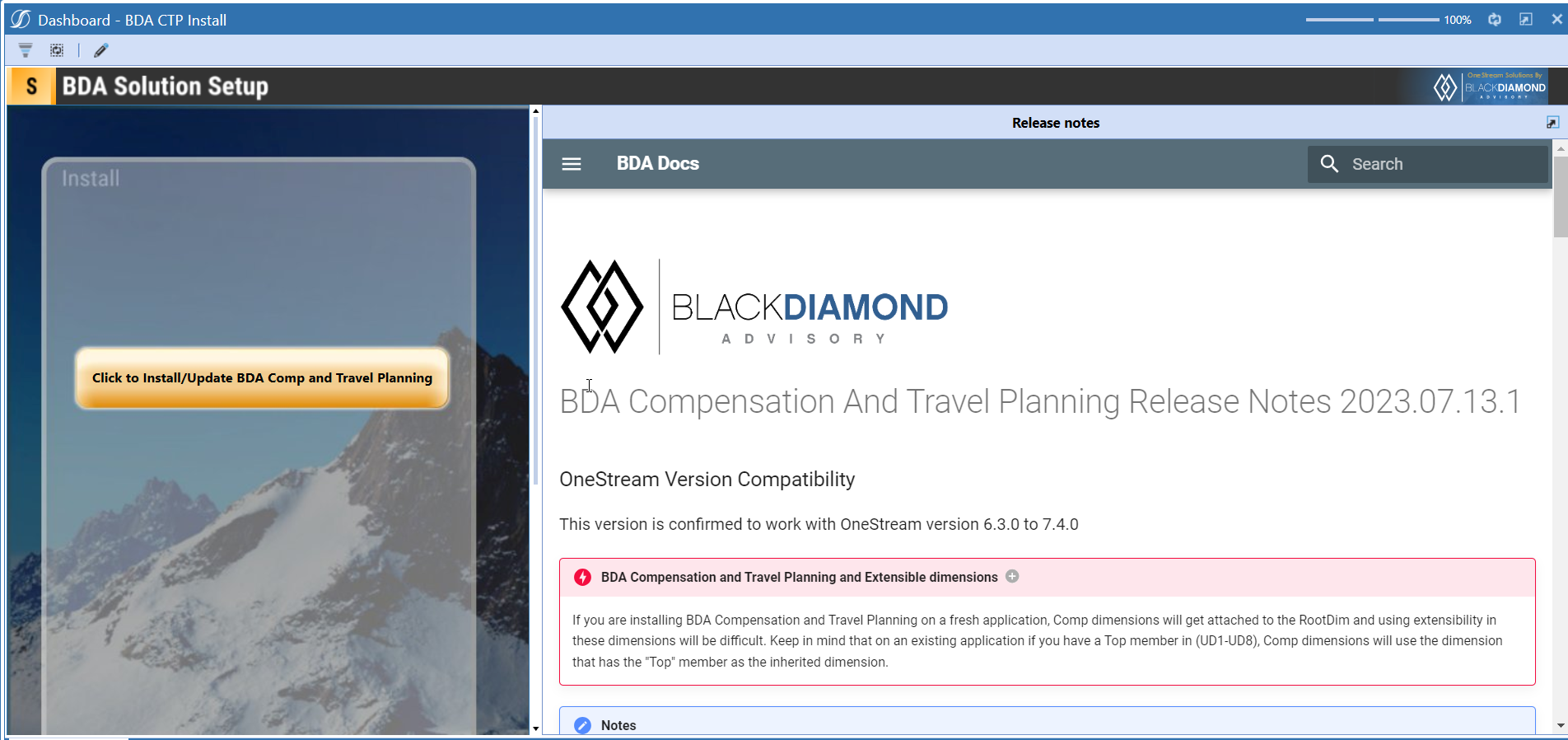

- Once completed, navigate to OnePlace -> Dashboards -> BDA Compensation and Travel Planning Setup

-

Click on dashboard BDA CTP Install

-

Click the button "Click to Install/Update BDA Comp and Travel Planning".

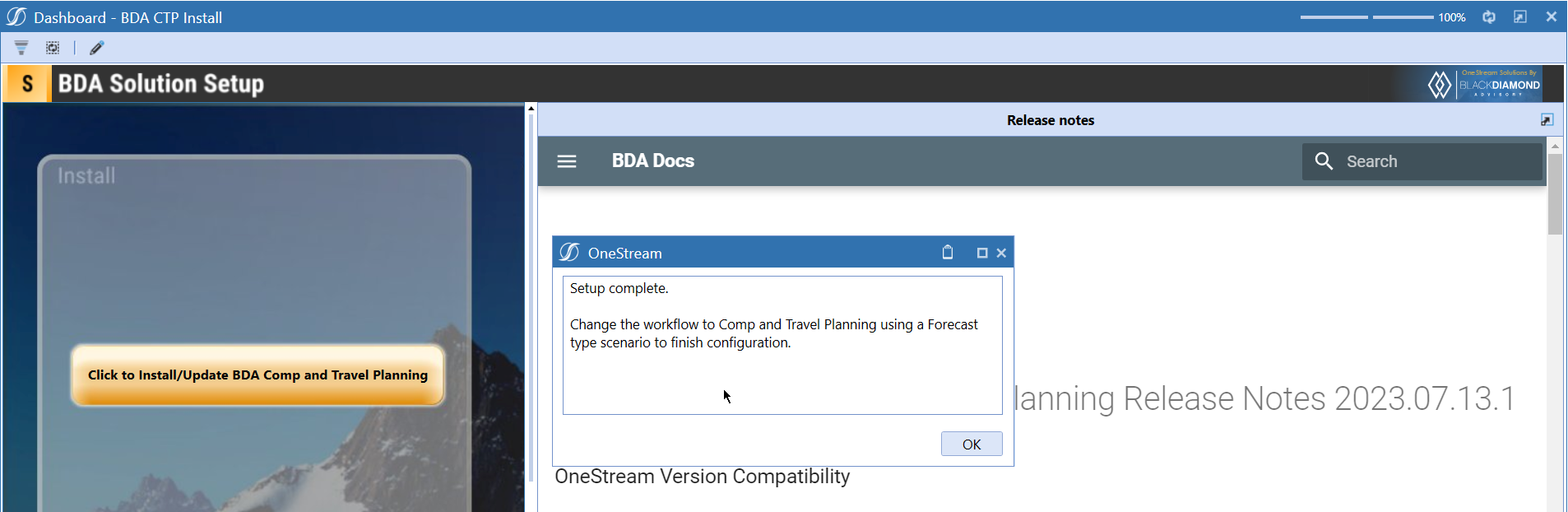

-

Once successful, you should see the following screen.